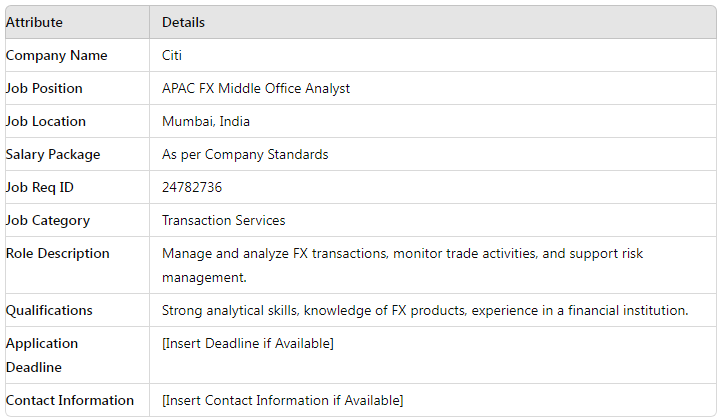

Citi Recruitment Drive:

Citi is seeking candidates for the position of APAC FX Middle Office Analyst in Mumbai, India. This role involves managing and analyzing foreign exchange transactions and ensuring accurate processing within the middle office operations. Responsibilities include monitoring trade activities, resolving discrepancies, and supporting risk management functions. Ideal candidates should have strong analytical skills, a solid understanding of FX products, and experience in a similar role within a financial institution. Citi offers a dynamic work environment with opportunities for professional growth. Interested candidates are encouraged to apply for this exciting opportunity.

Citi Recruitment Drive details:

Required Qualifications & Skills:

- Education: Bachelor’s degree or equivalent preferred.

- Experience: 1-2 years of relevant experience preferred; freshers are also considered.

- Knowledge: Fundamental understanding of FX products, trade lifecycle management, and related operational risks.

- Team Skills: Team-oriented with the ability to work collaboratively and independently.

- Personal Attributes: Self-motivated, flexible, and driven with a strong desire to succeed.

- Multitasking: Proven ability to manage multiple activities and projects concurrently in a high-risk environment.

- Communication: Clear and concise written and verbal communication skills.

Job Description & Responsibilities:

- Position: Securities & Derivative Analyst 1 (Entry-Level)

- Objective: Process orders and transactions from trading desks and branch offices, coordinating with the Operations – Transaction Services team for clearance, settlement, and investigation of client securities and derivatives transactions.

- Support: Provide analytical and administrative support to Front Office Sales and Trading, focusing on FX business.

- Lifecycle Management: Support lifecycle activities and interact with Business, Firm’s Clients, Operations, and Technology to manage post-execution issues.

- Control Functions: Perform control functions using intermediary processing systems and records.

- Daily Tasks: Complete daily tasks accurately and on time.

- Compliance: Ensure desk compliance with internal and external regulations at all times.

- Issue Management: Manage, escalate, and resolve all requests, inquiries, issues, and errors; identify policy gaps.

- Cross-Training: Willingness to cross-train across teams.

- Team Assistance: Assist the Team Lead with all necessary duties.

- Risk Assessment: Appropriately assess risk in business decisions, considering the firm’s reputation and safeguarding Citigroup, its clients, and assets. Drive compliance with laws, rules, and regulations, adhere to policy, apply ethical judgment, and manage control issues transparently.

Citi Recruitment Drive Application Process:

- Application Submission: Apply online through Citi’s careers portal or relevant job boards by submitting your resume and cover letter.

- Initial Screening: Applications will be screened based on qualifications, experience, and alignment with the job requirements.

- Assessment: Shortlisted candidates may be asked to complete an online assessment or test relevant to the role.

- Interviews: Qualified candidates will be invited for interviews, which may include phone, video, or in-person sessions with HR and hiring managers.

- Technical Evaluation: Candidates may undergo technical evaluations or case studies to assess their skills and suitability for the role.

- Final Interview: Successful candidates will participate in a final interview, potentially with senior management or department heads.

- Offer and Negotiation: Candidates who pass the interview stages will receive a job offer. This will include details of the salary package and other employment terms.

- Onboarding: Upon accepting the offer, candidates will proceed with the onboarding process, which includes background checks, documentation, and orientation.